are assisted living expenses tax deductible in 2021

If you arent paying at least. However you can only claim medical expenses that.

However these costs can only be deducted if their cost makes up more than 75 of the residents adjusted gross income AGI.

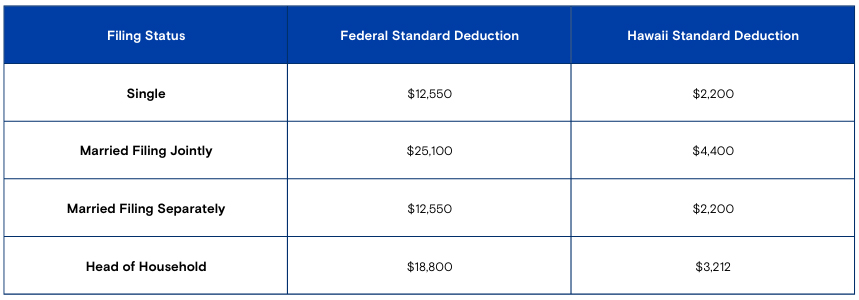

. For example if your medical expenses are 10000 and your annual income is 100000 you could only. The standard deductionwhich is claimed by the vast majority of taxpayerswill increase by 800 for married couples filing jointly going from 25100 for 2021 to 25900 for. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Answer Yes in certain instances nursing home expenses are deductible medical expenses. In the case of an assisted living community your loved one or an appropriate relative may qualify for a medical.

Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. A lot of the aforementioned expenses could be incurred whether the person is being cared for in a. Home modifications wheelchair ramps safety bars etc To calculate your total medical expense tax deduction determine the total amount of qualifying.

In 2021 that limit is set at 4300 but it typically does not include income they may receive from Social Security. Depending on the type of care a resident. The breakdown should also take into account any subsidies that reduce the attendant care expenses unless the subsidy is included in income and is not deductible from income.

For 2021 costs exceeding 75 of adjusted gross income AGI are deductible if theyre itemized. Other Things to Keep in Mind In order to claim medical expenses. Are Assisted Living Expenses Tax Deductible In 2021.

You can deduct your medical expenses minus 75 of your income. In preparation for his income tax return for 2021 I am not clear as to whether the full cost at the facility is tax deductible under medical expenses or if only a portion is deductible. How do I enter a multiple support agreement.

The IRS will have requirements so the family members can assisted living home expenses nursing home expenses and also treatments for Alzheimers disease. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid. Initiation or entrance fees related to medical care or assisted living.

Can I deduct these expenses on my tax return. In order for assisted living. If you your spouse.

An experienced elder law attorney will be able to weed through expenses incurred at an assisted living facility in order to determine if they qualify for a tax deduction.

Articles What Tax Deductions Are Available For Assisted Living Expenses Seniors Blue Book

Does Medicare Pay For Assisted Living

Tax Credits Vs Tax Deductions Making The Most Of Your Tax Benefits Bank Of Hawaii

Is Senior Home Care Tax Deductible

Are Senior Living Expenses Deductible On My Taxes

How Do You Deduct Health Insurance Premiums On Your Taxes Goodrx

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

What Are Tax Deductible Medical Expenses The Turbotax Blog

How To Record Tax Deductions For My Mother S Nursing Home Expenses

Tax Deductions For Assisted Living Expenses Westminster Baldwin Park

5 Things You May Not Know Are Tax Deductible

Deduct Expenses For Long Term Care On Your Tax Return Kiplinger

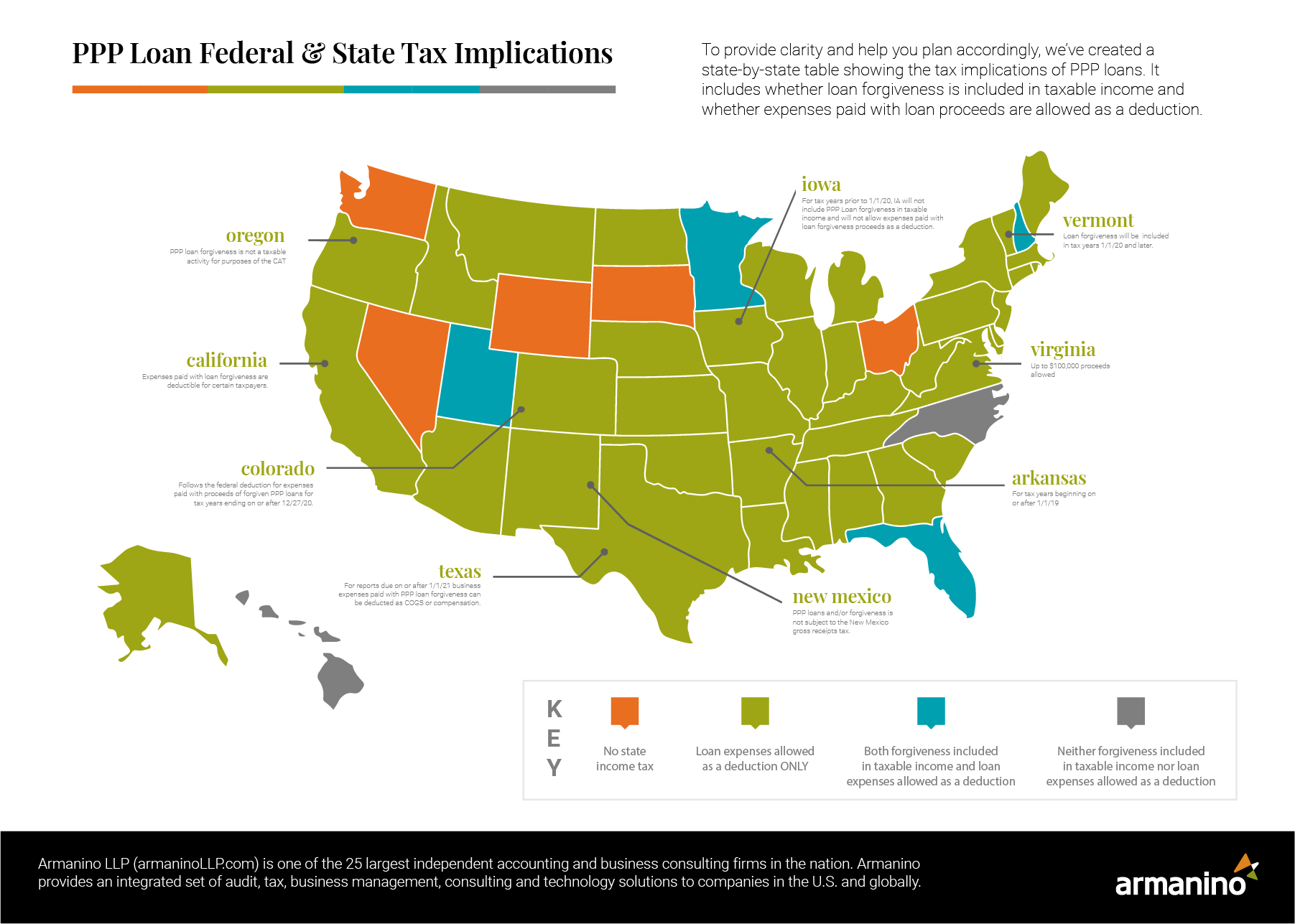

Ppp Loan Tax Implications Armanino

Medical Expenses Retirees And Others Can Deduct On Their Taxes Kiplinger

![]()

18 Real Estate Agent Tax Deductions To Save Money Tips Free Download

2021 Tax Benefit Amounts For Long Term Care Insurance Announced By Irs Ltc News

10 Tax Deductions For Seniors You Might Not Know About

Are Assisted Living Expenses Tax Deductible Medical Expense Info

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)